In the previous article we looked exclusively at FXI - iShares FTSE/Xinhua China 25 fund. In this section, we will compare FXI to PGJ. (Powershares Exchangetraded Fd Golden Dragon Halter Usx China Fund)

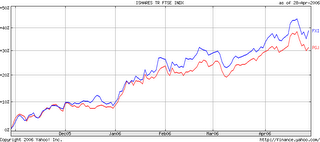

As can be seen in the chart above from Yahoo! FXI has out performed PGJ by about 8 percentage points in the past six months. Short term performance is hardly an indicator of long term performance. We will look into the holdings, objectives and the expense ratios charged by each ETF to see which one has a better prospect in the longer term.

FXI and PGJ both are in the same category - large cap growth segment. FXI holds 27 stocks from China. PGJ on the other hand invests in companies that are listed in the U.S stock market and derive majority of their revenue from China. PGJ has fifty-three stocks altogether in its portfolio.

FXI has an expense ratio of 0.74% where as PGJ has an expense ratio of 0.7%. FXI has 100% exposure to China whereas PGJ has 95% exposure to China. As we discussed in the last article, the Chinese government has a large say on how the companies it owns will do over long periods of time. PGJ has the same issues but somewhat to a lesser extent as it is investing in companies that derive large part of their revenues from China.

We looked at FXI holdings in the previous article. The PGJ holdings are described in detail here. The main areas of investment for PGJ are Energy (20%), Information Technology (23%), Industrials (10.4%), Consumer Discretionary (6.7%), Financials (4.6%), Materials( 8.3%) and Telecom Services (20%) and utilities (4.7%). The asset mix in PGJ is quite different compared to FXI. FXI invests in 24% in financials, 22% in oil and gas, 21% in telecom, 17% industrials, 10.6% basic materials and 4.3% in utilities.

The energy sector has done extremely well in past few months. This may partially describe the reason FXI has done well over the past six months. The asset mix of PGJ is quite different from FXI. If one is planning to invest greater than $10,000=00 in to China, it may make sense to split the assets into two funds.

No comments:

Post a Comment